Our customers and partners

Liqwith.io

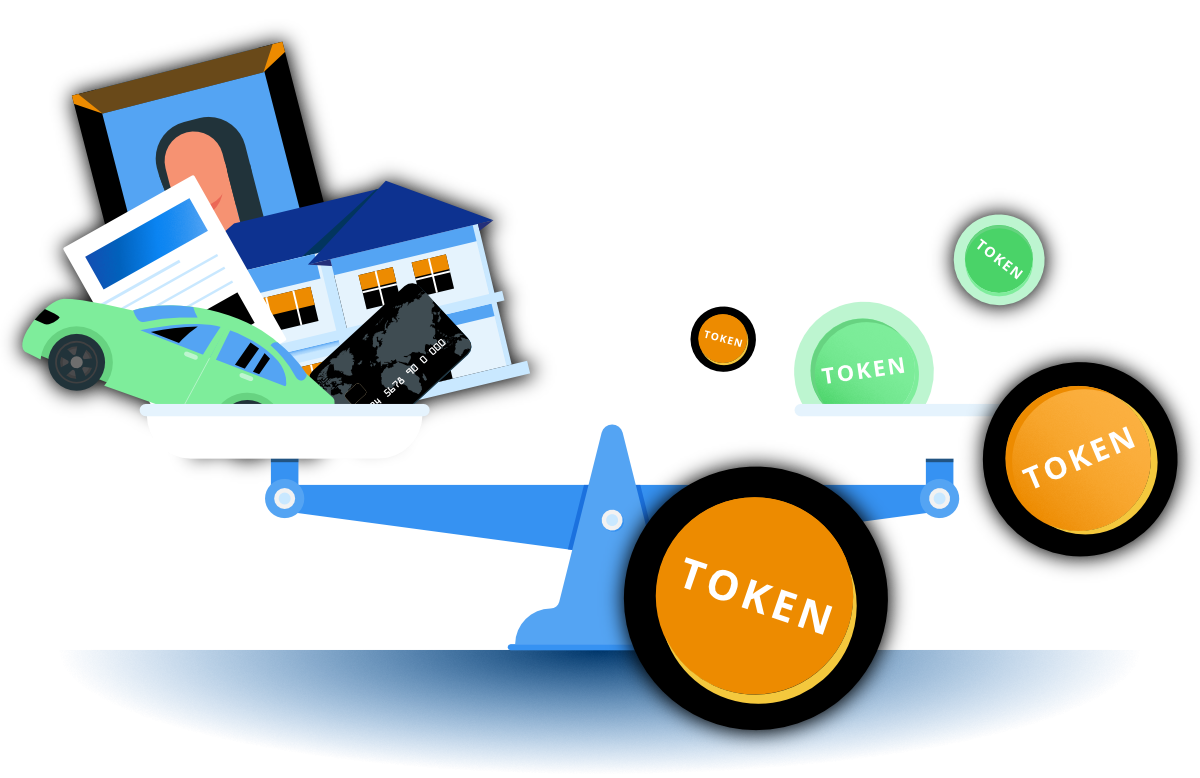

What is Tokenization?

The New Age of Tokenized Assets

Transforming Real-World Assets with Blockchain

Liqwith.io empowers businesses to tokenize tangible and financial assets, unlocking unprecedented liquidity and investor access. Tokenization converts assets like company shares, bonds, and physical assets—including energy, water, data, art, and more—into digital tokens, offering transparency, security, and fractional ownership.

Our platform connects investors with innovative investment opportunities, while companies gain access to new capital sources through the power of blockchain technology. With real-world assets at the core, we provide a seamless experience that bridges the gap between traditional finance and decentralized solutions.

Why choose Liqwith?

Liqwith.io is built on cutting-edge technology to ensure the safe and efficient tokenization of real-world assets.

Our platform simplifies the process for companies looking to raise capital and investors seeking new opportunities.

Real-World Assets as Tokenized Opportunities

At Liqwith.io, we focus on bridging the gap between traditional industries and blockchain technology, tokenizing a wide range of real-world assets.

How to get started

Simple and Secure Tokenization Process

Tokenizing real-world assets with Liqwith.io is straightforward and secure.

“Liqwith will help us support Small and Medium sized companies with an additional way of financing their plans and business needs. Keeping cost of financing low and allowing for clients, employees, suppliers and fans to participate in the company succes”

“Liqwith has the solution which is supporting is to create a modern and steward ownership based structure for our company, based on the latest technology and fully compliant with the regulator and our future developments”